The DOGE whale reduced its holdings - in the same week that the cryptocurrency hit a new annual high. The reduction in open positions caused the price of Dogecoin to fall to $0.36.

However, this is no longer the case today as these key stakeholders have resumed buying. Here's how this could affect the future value of Dogecoin.

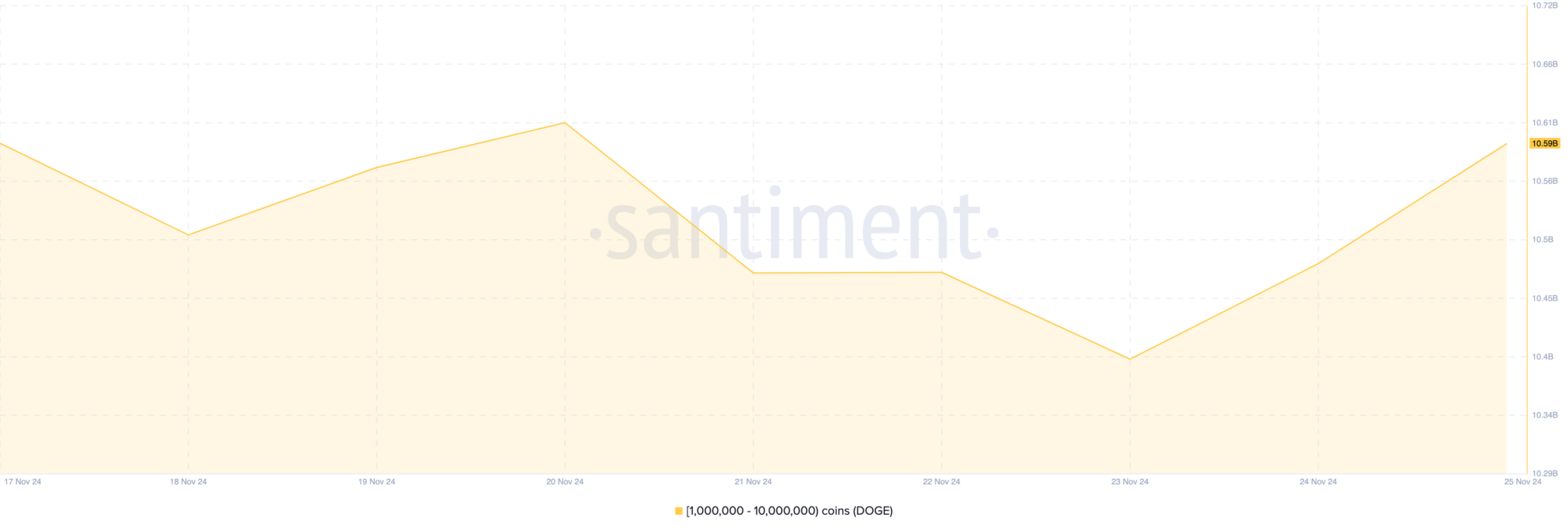

The balance of addresses holding 1 million to 10 million DOGE fell to 10.39 billion on Nov. 23, but has since risen to 10.59 billion, according to Santiment.

This suggests that Dogecoin whales took advantage of the fall over the weekend to accumulate around 200 million coins. At Dogecoin's current price of $0.42, that equates to $84 million worth of purchases. Such an accumulation of whales usually indicates an easing of selling pressure.

As a result, the surge in buying activity suggests that the price of Dogecoin could surpass the current $0.42. If that happens, then the prediction that Dogecoin could reach $1 could come true.

In addition, the Average Direction Index (ADX) has been steadily climbing. ADX is a technical analysis tool that helps traders assess the strength of a trend, whether bullish or bearish.

When ADX is above 25, it indicates strong directional momentum. Conversely, a reading below 25 indicates weakness. On the daily chart of Dogecoin, ADX has surged to 68.00, indicating a clear upward trend. As the token moves higher, it suggests that the price of Dogecoin may continue to rise.

A closer look at the daily chart shows that the price of Dogecoin is encountering resistance at $0.43. This drop is one of the reasons why the cryptocurrency has failed to rebound to $0.50. It is worth mentioning that trading volume has declined, making it difficult to sustain the upward trend.

Meanwhile, the bulls seem to be defending the $0.36 area. If it continues, then DOGE's value could climb to $0.48. In a highly bullish scenario, the meme coin could rally to the $1 mark. However, that may not happen if DOGE Whale decides to sell. Instead, the token could fall to $0.32.