introduction

The combination of financial nihilism and cryptocurrencies is profoundly changing the digital asset landscape, transforming memes from mere communication mediums into powerful financial instruments. This change marks a major transformation in the way value is created, perceived, and transferred in the modern digital society.

The rise of Meme marks a clear departure from traditional financial assets, which combine the unique characteristics of social interaction, technological innovation, and market psychology. The transformation from Dogecoin, which began as a satire on cryptocurrencies, to a mature market segment attracting significant capital and institutional attention, reflects the younger generation's new attitudes toward investment, wealth creation and community building in the digital age.

The phenomenon of Meme is not limited to speculation, but also represents a new way of social collaboration and value creation. These tokens become vehicles for community expression, digital identity, and shared cultural experiences. The success of Meme challenges traditional financial definitions of intrinsic value and asset fundamentals, demonstrating that the power of community consensus and social capital in the digital economy can rival traditional financial metrics.

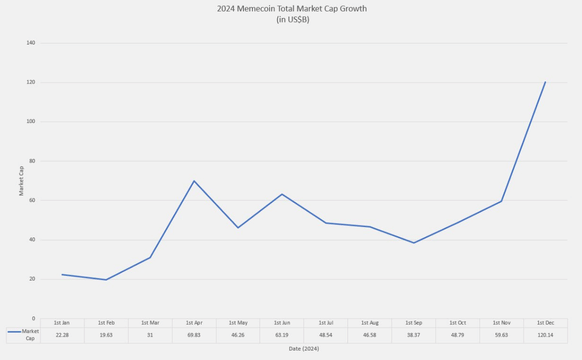

In 2024, the Meme industry showed phenomenal growth, with the total market cap soaring from about $20 billion in January to $120 billion in December, an increase of 500%.

Meme's total market cap growth in 2024 (in USD billion) Sources: CoinMarketCap, DWF Ventures

Foundation member

A traditional public offering requires a company to have a long track record of operations, steady revenue growth, and sound financial management. The process, which typically involves going through multiple rounds of private funding, filing numerous regulatory filings and paying high fees for professional services, often takes years and costs millions of pounds. Such system design serves as a quality check, but it also acts as a barrier to innovation for projects that challenge traditional business models.

The emergence of blockchain technology has completely upended this model. By introducing a permissionless system of smart contracts, blockchain effectively replaces many functions traditionally performed by financial intermediaries and regulators. This technological innovation has dramatically reduced the time and cost required to launch tradable assets, democratizing capital markets in an unprecedented way.

The reduction in friction has led to a new model of value creation that focuses more on community engagement and narrative appeal than traditional financial metrics. Today, projects can quickly test ideas in the marketplace, and their success or failure depends on community acceptance rather than institutional endorsement. This environment is particularly favorable for meme-driven projects because they rely on shared cultural awareness and community participation, creating powerful network effects.

Value creation process in crypto market versus traditional market

Efficient crypto infrastructure establishes a new model for the creation and distribution of digital assets. Rapid iteration cycles and reduced friction in value creation make the market more dynamic and responsive to change across all segments.

From traditional capital markets to crypto-driven value creation, this evolution highlights a fundamental shift in how new ideas are funded and scaled. In the traditional system, access to public investment markets is subject to a strict institutional framework that protects investors but also limits broad access to capital.

And in the crypto market, this shift has provided fertile ground for the development of Meme, allowing it to rise quickly and flourish.

Meme life cycle

The transformation of value creation in digital assets has led to an entirely new model in which community-driven growth and social capital are central drivers of success. The traditional barriers between creators and the marketplace have been broken down and replaced by a number of systematic and decentralized mechanisms that allow projects to be quickly deployed and communities formed.

This shift is particularly significant in the Meme space, where the combination of social interaction and financial markets creates unprecedented opportunities for value creation.

To understand this new paradigm, we need to explore how projects move from initial concept to financialization, driven by mainstream trends, social media, and communities. This lifecycle reflects a whole new way of how modern digital communities collaborate and capture value.

The life cycle of Meme creation begins with the accessibility of technology.

The four stages of the Meme creation life cycle

Phase 1: Deployment

The creation of Meme begins when creators visit platforms such as pump.fun or gra.fun. These platforms simplify what used to be a complex technical process into a convenient operational experience. The platform handles technical aspects such as deployment, smart contract verification, and initial liquidity provision. Processes that used to require weeks of development and large amounts of capital can now be completed in less than an hour with minimal initial funding, significantly lowering the barriers to entry in the digital marketplace.

Stage 2: Social capital formation

Once the token is deployed, the creator's focus shifts to community building. They are often active on multiple social platforms at the same time, such as:

Twitter/X is the primary channel for narrative building and engagement with the public.

Telegram groups facilitate community coordination and communication.

Discord channels provide a structured space for deeper technical discussions and community interactions.

This multi-platform strategy both expands reach and ensures a focused community. As communities form, three distinct but closely related forms of capital emerge and reinforce each other: social capital accumulates through community engagement, support from opinion leaders, and network effects.

Stage 3: Decentralized transactions

Through optimized liquidity deployment and automated market makers, financial capital provides a market for these tokens to trade.

The combination of market tools and social media helps participants maintain market heat through trend analysis and sentiment monitoring, creating a feedback loop that further enhances the influence of social and financial capital.

Stage 4: Value creation and distribution

When community members actively participate in value creation, the entire ecosystem becomes self-sustaining. Community-driven marketing is gradually replacing the traditional paid promotion model, while creator and user-generated content keeps the community active and attracts new members.

This life cycle presents a completely different model from traditional token offerings. In the traditional model, success often relies on large amounts of initial capital and institutional support. In the modern Meme ecology, community participation and social capital become the core driving force for value creation, thanks to the popularization of technology and simplified deployment processes.

The key innovation of these platforms is not only democratizing the token creation process, but also opening up the entire value creation process, enabling communities to create and capture value in ways that were previously only possible with well-funded institutions.

The Meme ecosystem: More than just pictures

Over time, different categories have evolved within the Meme ecosystem that create value around various social hot spots and trends and deliver significant financial returns.

DWF Labs: Meme will reshape the crypto market and lead a community-driven revolution in value creation

Types of memes

This table shows how different subcategories in the Meme ecosystem coexist and how they achieve high returns, demonstrating the market's ability to support multiple narratives at once - from pure Meme play to tokens with actual functionality.

Among established Meme projects, DOGE and SHIB have proven that Meme-based assets are marketable, while emerging projects like WIF show that there is still plenty of appetite for well-designed themed releases.

The most noteworthy development is the emergence of cross-domain tokens. These tokens combine the virality of a Meme with actual functionality. Ai-themed memes, for example, fuse the cultural appeal of memes with the transformative potential of AI to create a more complex value proposition. This innovation has not only attracted ordinary investors, but also institutional investors.

This trend marks a significant maturity in the field of memes: Memes are no longer purely cultural phenomena, but have become a testing ground for exploring how to combine social collaboration with practical applications to create new forms of value.

conclusion

Meme phenomenon is not only a short-term market hot spot, it reflects the profound changes in the way of value creation, cognition and distribution in the digital economy. While specific market trends may be constantly changing, rapid tokenization and community-driven value creation have become core features of the cryptocurrency industry.

The Meme market has grown from $20 billion in 2024 to $120 billion, and this growth shows that Meme is not just a flash in the pan, but a whole new asset class. This growth also reflects the market's recognition of social capital as a legitimate source of value in the digital age. At the same time, the complex infrastructure built around Meme - such as automated market makers and community governance tools - further solidifies Meme's long-term position in the cryptocurrency space.

This represents not only a new market area, but also an innovative model for society to collaborate and distribute value around a common goal. Going forward, the continued evolution of this market will provide us with even more insight into how digital communities create and capture value.

However, the challenge for market participants is how to maintain Meme's unique creative and community drive while building sustainable structures that can support long-term growth.